CENTRAL PACIFIC FINANCIAL (CPF)·Q4 2025 Earnings Summary

Central Pacific Financial Beats on EPS, NIM Expansion Drives 45% Profit Growth

January 28, 2026 · by Fintool AI Agent

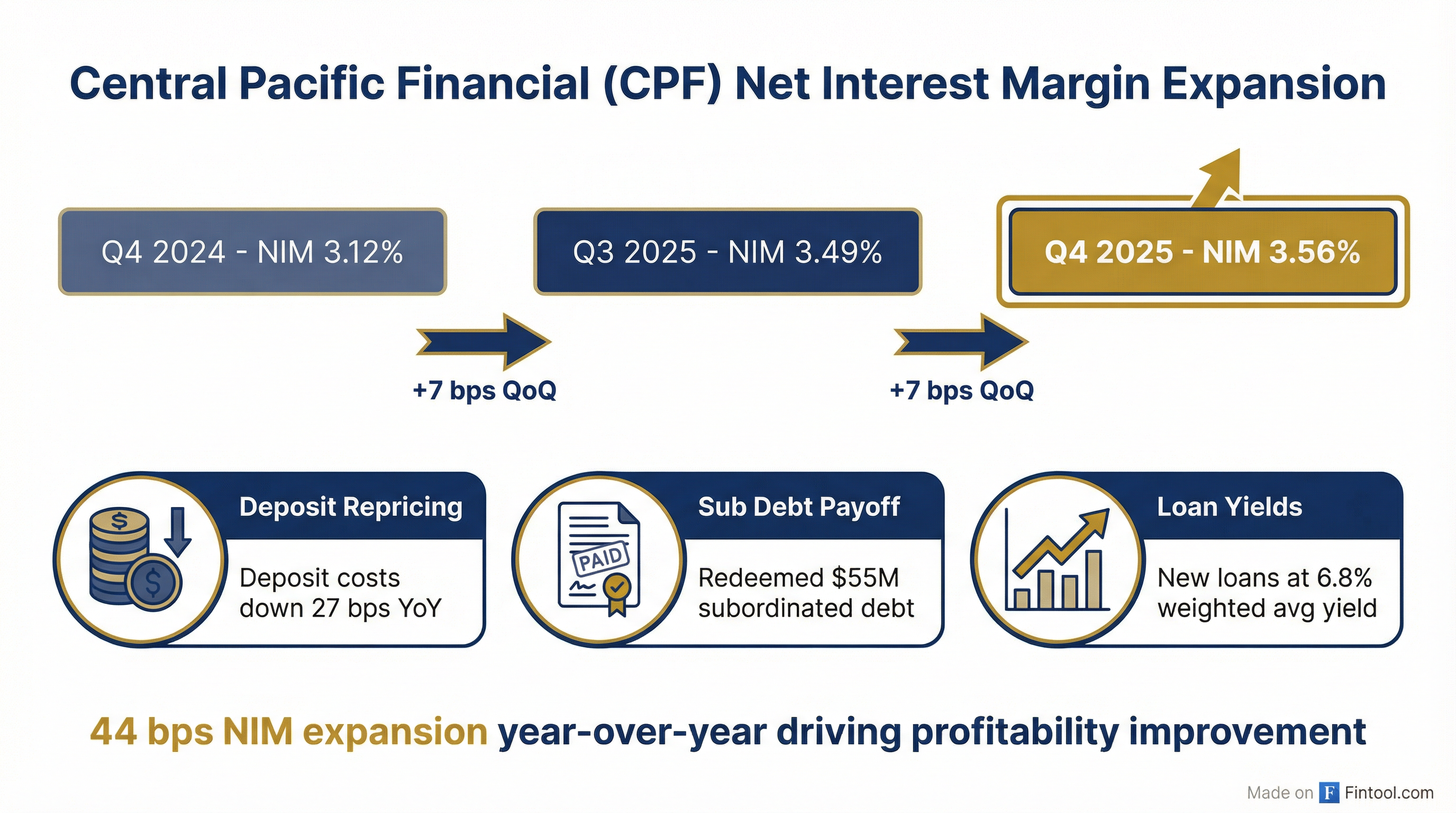

Central Pacific Financial Corp (NYSE: CPF), Hawaii's fourth-largest bank, delivered a strong Q4 2025 with EPS of $0.85 beating consensus by 14.9% and revenue of $76.3M exceeding estimates by 2.6% . The beat was driven by continued net interest margin expansion, now at 3.56%—up 44 basis points year-over-year . Q4 return on assets reached 1.25% and return on equity hit 15.41% .

The bank was recently named to Newsweek's list of America's Best Regional Banks for 2026—a recognition CEO Arnold Martines attributed to the team's "commitment to delivering exceptional service and building lasting relationships" .

Full year 2025 marked a breakout year: net income surged 45% to $77.5M ($2.86 diluted EPS) from $53.4M ($1.97 EPS) in 2024 . Management has positioned the bank for sustained returns through balance sheet optimization, capital management, and operational efficiency improvements that drove the efficiency ratio down to 59.88% from 68.91% .

Did Central Pacific Beat Earnings?

Yes—CPF beat on both EPS and revenue.

Consensus from S&P Global.

The EPS beat was amplified by share repurchases—530K shares for $16.3M in Q4 alone—reducing share count and boosting per-share earnings .

What Drove the Strong Quarter?

Three drivers underpinned Q4's outperformance:

1. Net Interest Margin Expansion

NIM expanded 7 bps quarter-over-quarter and 44 bps year-over-year to 3.56% . The primary drivers:

- Deposit repricing: Deposit costs fell 8 bps QoQ and 27 bps YoY as higher-rate CDs matured

- Subordinated debt redemption: CPF paid off $55M in sub debt in Q4, removing the higher interest expense

- Positive reinvestment cashflows: New loans originated at 6.8% weighted average yield vs. 5.0% on maturing loans

2. Operational Efficiency

The efficiency ratio improved dramatically to 59.88% from 68.91% in 2024—a 900 bps improvement . Key initiatives included:

- 90+ process automation improvements with straight-through processing

- Operations Center consolidation into main office saving ~$1M annually

- Branch system enhancements providing 80%+ time savings on teller balancing

3. Capital Deployment

Management executed a balanced capital return strategy:

- Share repurchases: $23.3M in 2025 (788K shares); new $55M authorization for 2026

- Dividend increase: Raised quarterly dividend 3.6% to $0.29/share

- Capital ratios remain strong: CET1 at 12.7%, well above the 11-12% target

How Does 2025 Compare to 2024?

The year-over-year improvement was substantial across all key metrics:

Management noted this performance "broke through the historical trend" and achieved initial profitability targets .

How Did the Stock React?

CPF shares were trading near $31.69 on the day of the earnings release. CEO Arnold Martines highlighted that total shareholder return over the past 3 years was 77%, reflecting both share price appreciation and dividends . The stock has significantly outperformed Hawaii peers (+35%) and national peers (+7%) .

What Did Management Guide for 2026?

Management provided detailed 2026 guidance that implies positive operating leverage:

Management noted the interest-bearing deposit beta should remain in the 25-30% range with two expected Fed rate cuts in 2026 . The deposit spot rate at year-end was 89 basis points, providing room for continued funding cost reduction .

On loan growth, several large construction and commercial mortgage fundings were delayed from Q4 to Q1/Q2 2026, weighted more toward Q2 . Some of these are construction projects that will require higher reserves upon funding .

What's the Loan and Deposit Outlook?

Loan Portfolio

Total loans stood at $5.29B, down modestly from $5.33B a year ago . Management is intentionally shifting the mix:

- Growing: CRE and construction loans up $162M YoY

- Shrinking: Residential mortgage and HELOC down $130M YTD, reducing low-yielding, long-duration exposure

The portfolio is 84% Hawaii-focused with 80% secured by real estate . Mainland exposure (CRE, C&I, Consumer) comprises 15-20% of total loans and provides geographic diversification .

Deposit Franchise

Total deposits were $6.61B with a highly favorable composition :

- 29% non-interest bearing demand

- 21% interest-bearing demand (0.13% WAR)

- 35% savings & money market (1.38% WAR)

- 15% time deposits (2.79% WAR)

No brokered deposits. 53% of customers have been with CPB for 10+ years . This sticky, low-cost deposit base provides a NIM advantage vs peers.

What About Credit Quality?

Asset quality remained solid within expected operating ranges :

Net charge-offs improved to 0.18% annualized from 0.29% a year ago. Criticized loans increased primarily due to workout activity but remain manageable at 1.35% of total loans.

Provision expense for Q4 was $2.4M, including $1.7M added to the allowance and $0.7M to the reserve for unfunded commitments . The decrease in provision expense was driven by declining loan balances and improvements in asset quality and macroeconomic forecasts . Total risk-based capital stood at 14.8% .

What Strategic Initiatives Are Underway?

Management highlighted several growth and diversification initiatives:

1. International Expansion In Q4, CPF signed a strategic partnership with Korea Investment & Securities, one of South Korea's leading financial institutions . This collaboration expands international reach and creates new deposit opportunities by offering banking services to Korean customers seeking investment and business opportunities in Hawaii . This complements existing Japan partnerships, with 2026 deposit growth expected to be driven by strategic partnerships in both Japan and Korea .

2. Positive Operating Leverage Framework The bank implemented an operational excellence program integrating "people, processes and technology to drive efficiency, innovation and growth" . Results are visible in the 900 bps efficiency ratio improvement.

3. Capital Return Acceleration The new $55M share repurchase authorization for 2026 (6.7% of market cap) plus the dividend increase signals confidence in sustained profitability .

Q&A Highlights: What Did Analysts Ask?

Key themes from the analyst Q&A session:

On Loan Growth Trajectory (Matthew Clark, Piper Sandler) Management confirmed delayed loan fundings will close in Q1/Q2 2026, with Q2 likely heavier . Q4 originations were ~$300M—management noted they need to exceed that level to achieve net loan growth . Despite flat full-year loans, construction and commercial mortgage grew 10% YoY as planned .

On Deposit Competition (David Feaster, Raymond James) Core deposit growth came from both new customer acquisition and "primacy"—deepening relationships with existing customers . CPF holds ~13% of the Hawaii banking market and sees significant opportunity to grow share .

On Hawaii Economy (Kelly Motta, KBW) UHERO upgraded their Hawaii forecast, though from a "deeper downturn to a lighter downturn"—moving in the right direction but still cautious . Growth opportunities remain primarily in commercial: C&I, commercial mortgage, and construction .

On Expense Flexibility (Kelly Motta, KBW) CFO Dayna Matsumoto noted the bank has flexibility to adjust expenses based on revenue performance . Planned investments include sales management systems and data platform enhancements, offset by continued automation and process improvements .

What Are the Risks?

Management's forward-looking statements flagged several risk factors :

- Tourism sensitivity: Hawaii's economy depends heavily on visitor arrivals, which were down 3.6% in November 2025

- Interest rate environment: While positioned for falling rates, further Fed cuts could pressure loan yields

- Trade policy uncertainty: Potential tariffs under the current U.S. administration could impact supply chains and consumer confidence

- Natural disaster exposure: Hawaii faces risks from wildfires, volcanic eruptions, hurricanes, and tsunamis

On the positive side, Hawaii's economy has proven resilient—experiencing only half the GDP decline of the U.S. mainland in past recessions . Defense spending contributes $17.4B (16%) to state GDP .

What Should Investors Watch Going Forward?

Key metrics to monitor:

- NIM trajectory as deposit repricing matures

- Loan growth returning after intentional portfolio optimization

- Credit quality trends, particularly in mainland consumer exposure

- Tourism recovery trends affecting Hawaii's broader economy

- Execution on Korea/Japan deposit growth initiatives

Capital allocation priorities:

- CET1 target: 11-12% (currently 12.7%)

- TCE target: 7.5-8.5% (currently 8.0%)

- ~40% dividend payout ratio

- Opportunistic share repurchases

Bottom Line

Central Pacific delivered a standout Q4 capping a breakout 2025. The 45% profit growth was driven by fundamental improvements—NIM expansion, operational efficiency, and disciplined capital deployment—not one-time gains. At ~10.9x trailing earnings with a 3.6% yield and $55M in authorized buybacks, valuation remains undemanding for a bank producing 13%+ ROE.

The key question is sustainability: can CPF maintain this profitability as deposit repricing tailwinds fade? Management's positioning for falling rates (29% of loans reprice within 1 year, 90%+ of CDs within 1 year) suggests they're prepared for multiple scenarios.